SENIORS REAL ESTATE SPECIALIST - SRES

A Seniors Real Estate Specialist, SRES, as a Realtor® who is uniquely qualified to assist seniors in housing sales and purchases. The SRES designation is awarded only to Realtors who have additional education on how to help seniors and their families with later-in-life real estate transactions.

They also draw upon the expertise of a network of senior specialists, such as estate planners, CPAs, and eldercare lawyers, and are familiar with local community resources and services. Their mission is to help seniors and their families navigate the maze of financial, legal and emotional issues that accompany the sale of a home.

What is an SRES®?

To successfully earn the SRES® Designation, a REALTOR® has to demonstrate the necessary knowledge and expertise to counsel clients age 50+ through major financial and lifestyle transitions involved in relocating, refinancing, or selling the family home.

Why Work With Me

As a Seniors Real Estate Specialist SRES designated Realtor, Matt Masson is trained to assist seniors and those 50+ years of age with their real estate needs. The truth is that people 50+ have specific needs that change as they age. They get older and tend to have needs that can include aging in place, relocating, remodeling, moving in with family or any combination of the above.

This is a very serious trend as the older generation is focusing on their needs.

Senior housing can be more affordable in 55+ communities. However; assoc. dues can be higher so all things must be considered. Call an expert Seniors Real Estate Specialist like Matt Masson to help sort out what the best move for you or your loved one may be.

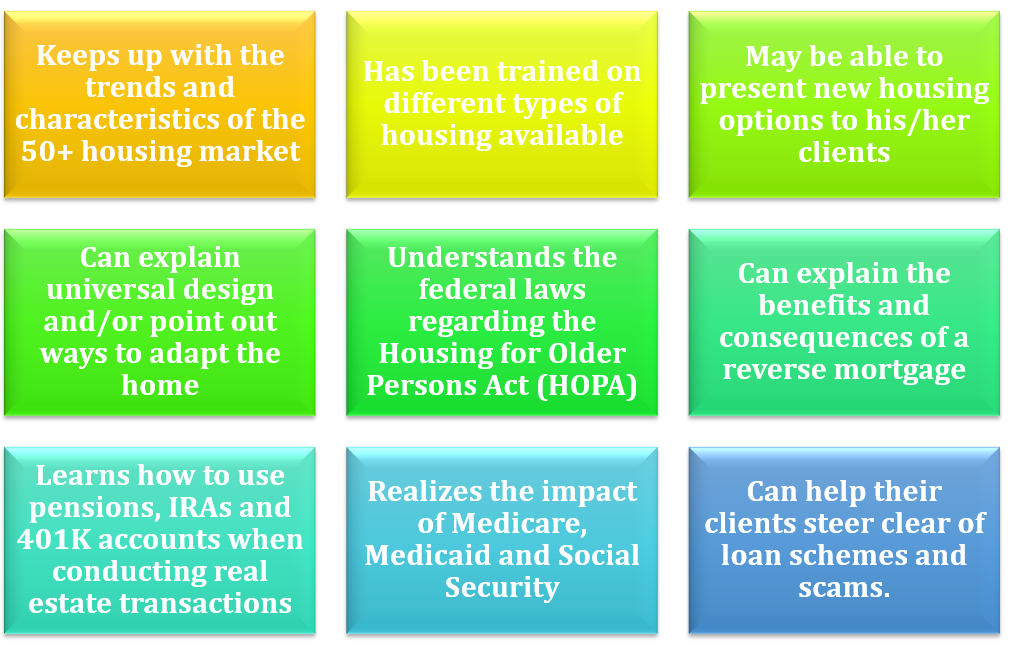

Seniors Real Estate Specialist or SRES® designees are REALTORS® qualified to address the needs of home buyers and sellers age 50+

By earning the SRES® Designation, agents have demonstrated the necessary knowledge and expertise to counsel clients age 50+ through major financial and lifestyle transitions in relocating, refinancing, or selling the family home. Seniors need to make choices and sometimes they no longer want to be a homeowner. Maybe they want to travel or they want to move into an assisted living facility. SRES designated brokers are qualified to help them make these informed decisions. Call Matt Masson today for a free consultation 415.902.5590.

Some important SRES topics include:

-Housing for Older Persons Act (HOPA)

These topics affect seniors and 50+ individuals as they navigate all the options in real estate and real estate finance for seniors. The market continually adapts and we stay in tune to the constant market changes for seniors and other 50+ buyers and sellers.

How can SRES Help You Plan for Your Future Housing Needs?

Most of us put time and effort into planning for retirement. That is, we plan for money related issues such as retirement funds. Secondly, people plan for long-term care and life insurance. Deciding on where you’ll live as you age often takes a backseat during retirement planning.

Whether you are considering aging in place, downsizing, purchasing a rental property, or even upsizing to a new location, dealing with real estate transactions and choices can be a confusing maze to negotiate, even for experienced home buyers. Beyond the complexity of real estate transactions, those over fifty five are often more sophisticated shoppers and can benefit from a knowledgeable SRES representative.

The Benefits of Using an SRES Agent

-Customized approach to your living situation that fits in with your overall life plan.

-Awareness of options like senior-based communities and aging in place needs.

As someone deciding on where they’ll live as they grow older, there are unique challenges to financing and home accessibility that come with real estate and future housing needs. When planning real estate changes over age fifty, an SRES can be the professional who actually works for the client and has the experience and training to understand the unique challenges facing seniors when it comes to housing.

How can an SRES help you plan your housing needs?

Because an SRES focuses on retirees and seniors, they should understand the need to plan ahead and the challenges that face seniors as they age with regards to balancing finances, mobility, health, and personal needs. They have also been trained to understand that the right housing for today may not meet your needs a few years down the road. There are three main ways in which an SRES can guide you in planning your future housing needs.

An SRES understands senior housing options

SRES designees are trained in all of the options for senior housing available. Much more than simply aging in place in your current home or moving to an assisted living facility or retirement home, there are vibrant options for today’s seniors. Additional options include things like planned senior communities with new homes designed for the needs of seniors.

These communities also have access to extra services seniors may need such as senior-friendly exercise opportunities and transportation. SRES agents are also trained in understanding the requirements of the Housing for Older Persons Act (HOPA) that sets forth guidelines and exemptions on housing developments and communities targeted towards seniors.

Part of understanding senior-specific housing is knowing the type of features that seniors will eventually need in a home. An SRES knows which housing communities have homes built under Universal Design tenants–homes designed with the changing needs of seniors in mind.

Universal Design includes things such as no step entries, one story floor plans, wider doorways, open floor plans with extra floor space, senior-friendly bathrooms, and more features designed to help seniors live comfortably without feeling like they have turned their home into a hospital ward.

An SRES can assist in dealing with financial options for real estate

An SRES will work with you to prepare for financial challenges that can arise out of a real estate transaction. This is not only for buying and selling a home, but also if you choose to age in place and remodel your home.

They also understand reverse mortgages, both the positive sides and the potential downsides of that type of mortgage for seniors. Further, SRES agents are trained to spot mortgage and other loan schemes that are designed to trick and scam seniors out of their finances or even their homes.

About 55 percent of people in the U.S. die without a will or estate plan and this can put heirs through unnecessary expense and frustration in trying to finalize arrangements of your estate. An SRES can introduce you to qualified professionals in the field of estate planning.